XRP Price Prediction: 2025-2040 Outlook Amid Bullish Technicals and Regulatory Wins

#XRP

- Technical Strength: Price above MA + bullish MACD signal upside potential

- Regulatory Tailwinds: SEC lawsuit resolution removes a major overhang

- Strategic Expansion: Ripple's acquisitions aim to dominate enterprise blockchain payments

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerge Amid Strong Market Performance

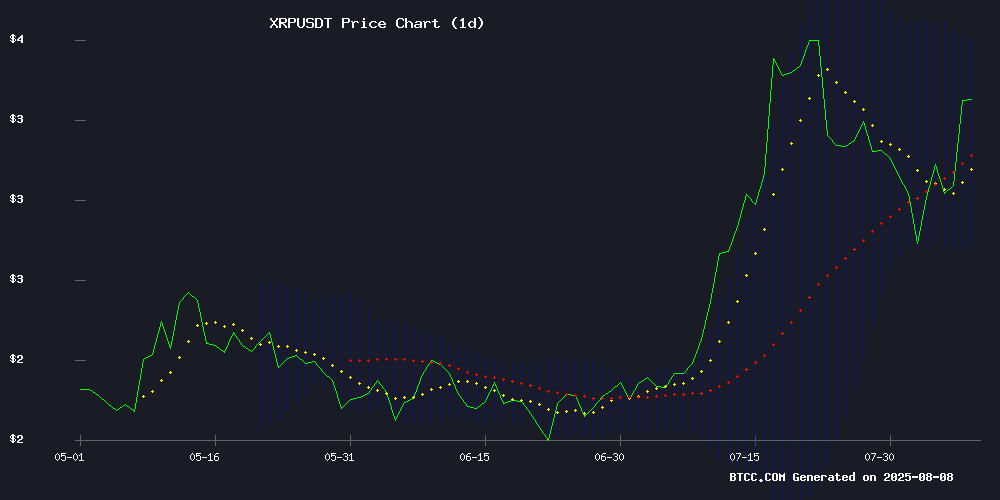

XRP is currently trading at, comfortably above its 20-day moving average of 3.1567, indicating a bullish trend. The MACD (12,26,9) shows positive momentum with a value of, while the Bollinger Bands suggest potential volatility with an upper band at 3.5526 and lower band at 2.7609. According to BTCC financial analyst Emma, 'The technical setup favors buyers, with key resistance at 3.55 and support NEAR 2.76.'

XRP Market Sentiment: Legal Clarity and Strategic Moves Fuel Optimism

Recent developments, including Ripple'sand the conclusion of the SEC lawsuit, have significantly boosted market confidence. XRP surged 13% to $3.36 post-announcement. Emma notes, 'The resolution of regulatory uncertainty and Ripple's aggressive expansion into DeFi could drive further upside, especially with ETF approval rumors for October 2025.'

Factors Influencing XRP’s Price

XRP Price Prediction and Rising Competition in DeFi

XRP's price prediction has surged to the forefront of crypto discussions following Ripple Labs' partial legal victory against the SEC. The regulatory clarity has reignited institutional interest, with XRP climbing 30% in July to trade at $3.05. Analysts speculate a test of $1.10 by September if bullish momentum persists, though on-chain data suggests key support levels lie at $2.80 and $2.48.

Meanwhile, attention is shifting toward Remittix (RTX), a DeFi contender gaining traction for its real-world utility. Market observers note its potential to outpace XRP in functional applications, signaling a broader trend of investors diversifying into fundamentally strong altcoins. The project's upcoming Q3 developments could further solidify its position as a viable alternative.

SEC Commissioner Crenshaw Maintains Anti-Crypto Stance in XRP Lawsuit Appeal Vote

The U.S. Securities and Exchange Commission faces a pivotal vote on dismissing its appeal against Ripple Labs, with Democratic Commissioner Caroline Crenshaw emerging as a key dissenting voice. Crenshaw's consistent opposition to crypto-related approvals—including spot ETFs—preserves the legacy of former SEC Chair Gary Gensler's stringent regulatory approach.

Legal experts highlight Crenshaw's use of Rule 431 to challenge delegated authority, creating market uncertainty. A technical error on the SEC website showing Gensler's vote dated August 2025 briefly alarmed observers, though lawyers confirmed his current lack of decision-making power.

Former SEC attorney Marc Fagel and industry analysts like Bloomberg's James Seyffart have criticized the commissioner's rigid stance, which contrasts with growing institutional acceptance of digital assets. The outcome of this vote could set a precedent for how the SEC treats ongoing crypto enforcement cases.

Ripple Acquires Rail for $200M Amid SEC Lawsuit Resolution

Ripple Labs has announced a $200 million acquisition of Rail, a stablecoin-powered global payments platform, shortly after both parties moved to dismiss appeals in the SEC's high-profile lawsuit. The case, which accused Ripple of selling XRP as an unregistered security, had cast uncertainty over the company's future.

The timing of the deal has drawn scrutiny from observers like Bill Morgan, who noted its proximity to Ripple's legal milestone. The acquisition combines Ripple's liquidity infrastructure with Rail's licensed payment rails and virtual account technology, creating a 24/7 global settlement network accessible via API.

Pending regulatory approvals expected by Q4 2025, the merger positions Ripple to expand its institutional payment solutions while potentially strengthening its case for a national bank charter. The move signals Ripple's strategic pivot toward compliance-friendly infrastructure following its protracted legal battle.

Ripple-SEC Lawsuit Concludes With Joint Dismissal of Appeals

The U.S. Securities and Exchange Commission and Ripple Labs have filed a joint dismissal of their respective appeals, bringing finality to the landmark XRP case. The move follows Judge Analisa Torres' 2023 ruling that distinguished between retail and institutional sales of the cryptocurrency.

Legal costs will be borne separately by both parties under the terms of the Federal Rule of Appellate Procedure 42(b)(1) dismissal. Ripple's Chief Legal Officer Stuart Alderoty confirmed the procedural conclusion via social media, signaling an end to the four-year legal battle that began in December 2020.

The resolution leaves standing Judge Torres' precedent-setting decision that secondary market XRP transactions don't constitute securities offerings. Institutional sales remain the only activity found to violate securities regulations in the case that reshaped cryptocurrency enforcement.

Can These Three Bullish Reasons Pave The Way for XRP ETF Approval In October 2025?

The U.S. Securities and Exchange Commission is reviewing multiple applications for XRP-based exchange-traded funds, with a final decision expected by October 2025. Three key factors are fueling optimism for approval: the dismissal of the SEC's lawsuit against Ripple Labs, Ripple's strategic $200 million rail acquisition, and growing institutional confidence in XRP's regulatory clarity.

The settlement between Ripple and the SEC removes a major obstacle, with market analysts now estimating a 95% probability of ETF approval. Ripple's infrastructure investments through acquisitions are strengthening its compliance profile and appeal to institutional investors.

Ripple-SEC Lawsuit Concludes as XRP Security Debate Reignites

The protracted legal battle between Ripple Labs and the U.S. Securities and Exchange Commission reached its finale with a joint stipulation of dismissal. While the agreement preserves Judge Torres' landmark 2023 ruling that XRP secondary market sales don't constitute securities offerings, it maintains Ripple's liability for institutional sales violations. Market reaction was immediate—XRP prices surged 12% on the news.

Controversy flared when former SEC attorney Amanda Fischer disputed claims that the agency ever classified XRP itself as a security. Pro-XRP attorney John E. Deaton swiftly countered, citing page 24 of SEC court filings where prosecutors explicitly argued secondary XRP transactions represented investment contracts. The regulatory ambiguity continues to cast shadows even as the case closes.

Ripple Secures Landmark Legal Victory as SEC Case Concludes, XRP Deemed Non-Security

Ripple Labs Inc. has achieved a decisive legal victory in its prolonged battle with the U.S. Securities and Exchange Commission, with the Second Circuit Court dismissing all remaining appeals. The resolution confirms XRP's status as a non-security, providing unprecedented regulatory clarity for the sixth-largest cryptocurrency by market capitalization.

Market response was immediate, with XRP surging 10% on the news. The ruling specifically validates Ripple's programmatic sales and distributions to non-institutional entities, establishing legal precedent under the principle of res judicata. This outcome removes a critical obstacle that had hindered institutional adoption since the SEC's initial 2020 lawsuit.

Industry analysts anticipate the decision will accelerate developments including potential XRP ETF applications and expanded enterprise adoption. The resolution marks a watershed moment for cryptocurrency regulation, potentially influencing ongoing SEC cases against other blockchain firms.

SEC and Ripple End Legal Battle, Clearing Path for XRP

The U.S. Securities and Exchange Commission and Ripple Labs have settled their protracted legal dispute, dismissing all remaining appeals in the XRP case. A 2023 court ruling remains intact: XRP traded on public exchanges does not qualify as a security, while certain institutional sales were deemed non-compliant. Ripple will pay a $50 million penalty—significantly lower than initial demands.

Market sentiment has turned bullish as regulatory clarity emerges. XRP’s price surged on the news, reflecting renewed investor confidence. The resolution removes a major obstacle to broader cryptocurrency adoption, particularly for payment-focused assets.

Neither party will recover legal fees, signaling a clean break from litigation. The outcome sets a precedent for how regulators may approach similar digital assets moving forward.

Ripple vs SEC Lawsuit Concludes as Both Parties Drop Appeals

The protracted legal battle between Ripple Labs and the U.S. Securities and Exchange Commission has reached its conclusion. A joint dismissal filing confirms both parties have withdrawn their appeals in the Second Circuit Court, effectively ending litigation that has loomed over XRP for years.

Market participants greeted the news with cautious optimism. Former SEC attorney Marc Fagel clarified the procedural finality: while administrative formalities remain, the courts no longer have an active role. This resolution removes a significant regulatory overhang that had constrained XRP's market potential since 2020.

The outcome sets an important precedent for cryptocurrency regulation through enforcement. With the case settled, attention now turns to how exchanges will respond to regulatory clarity around XRP's status. Industry observers anticipate potential relistings and renewed institutional interest in the asset.

XRP Price Surges 13% to $3.36 as Ripple Secures Major Acquisition Deal

XRP rallied 13.22% to $3.36 following Ripple's $200 million acquisition of Rail, a stablecoin infrastructure platform. The move strengthens Ripple's position in the $279 billion stablecoin market, particularly for its RLUSD token.

Technical indicators show bullish momentum, with the RSI at 62.94—healthy territory without overbought conditions. The price broke through key resistance levels, surpassing the psychological $3 barrier.

Market sentiment turned decisively positive as investors anticipate regulatory clarity from the SEC's pending decision on Ripple's appeal withdrawal. Institutional confidence grew further with BNY Mellon and Swiss AMINA Bank backing Ripple's RLUSD stablecoin.

Ripple Acquires Stablecoin Platform Rail for $200M to Boost Enterprise Payments

Ripple has agreed to acquire stablecoin payments platform Rail for $200 million, a move designed to strengthen its enterprise digital asset infrastructure and expand its footprint in the stablecoin-powered remittance market. The deal, pending regulatory approval, is slated to close in Q4 2025.

The acquisition positions Ripple to capitalize on the rapidly growing B2B stablecoin sector, projected to hit $36 billion by 2025. Rail currently processes over 10% of transactions in this space, offering Ripple immediate scale in a high-growth vertical.

Integration of Rail's technology will enhance Ripple's recently launched RLUSD stablecoin, providing enterprises with virtual accounts, automated back-office processing, and access to partner banking networks. "Rail will accelerate stablecoin adoption for cross-border payments," said Ripple President Monica Long.

The deal underscores Ripple's aggressive M&A strategy as it seeks to dominate blockchain-based financial infrastructure. Rail's platform uniquely enables stablecoin transactions without requiring end-users to hold cryptocurrencies directly - a key advantage for institutional adoption.

XRP Price Predictions: 2025, 2030, 2035, 2040 Forecasts

| Year | Price Target (USDT) | Key Drivers |

|---|---|---|

| 2025 | 4.50 - 5.80 | ETF approval, DeFi adoption |

| 2030 | 12.00 - 18.00 | Institutional use cases, cross-border payments |

| 2035 | 25.00 - 40.00 | Mainstream financial integration |

| 2040 | 50.00+ | Global reserve asset potential |

Emma highlights, 'XRP's utility in payments and regulatory clarity position it for exponential growth, though macroeconomic factors remain a wild card.'